The 9-Minute Rule for The Pros and Cons of Using E-Check Means for Transactions

Understanding the Basics of E-Check Means: A Comprehensive Guide

E-check, additionally known as electronic inspection, is a repayment procedure that allows people and companies to transmit funds digitally from one banking company profile to another. This remittance procedure has gained significant appeal in recent years due to its advantage and surveillance. In this complete overview, we are going to check out the rudiments of e-check means and how it works.

What is an E-Check?

An e-check is a kind of electronic settlement that performs similarly to a traditional paper check. Instead of literally writing out a check and mailing it, an e-check makes use of digital innovation to transmit funds from one bank account to another. The method involves inputting the required banking information into an on-line body or software application plan.

How Does an E-Check Work?

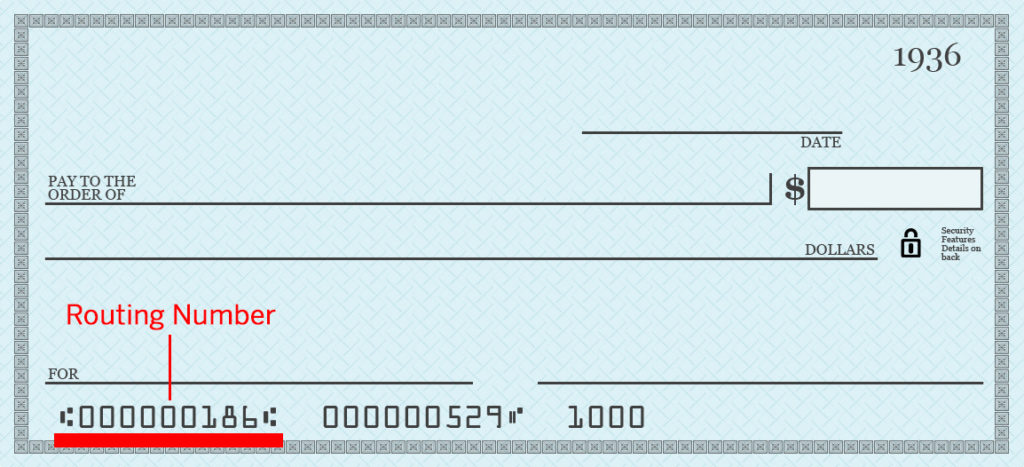

To make use of e-check as a remittance procedure, both parties should have legitimate banking company accounts with ample funds available for the transaction. The individual launching the settlement must supply their banking company option variety and account amount, along with consent for the deal volume.

Once this info is suggestionsed into the device or software program course, it is tightly transferred by means of different systems until it reaches the acquiring gathering's bank. The receiving party's financial institution after that verifies that there are adequate funds available and refine the transaction accordingly.

The entire process usually takes in between two to three business days for funds to be moved successfully from one profile to another.

Benefits of Making use of E-Check Means

There are actually several perks associated along with utilizing e-check means as a settlement method:

1) Convenience: E-checks can be launched coming from any sort of location along with internet get access to at any time of day or evening.

2) Protection: E-checks use safe and secure systems and file encryption modern technology, creating them less susceptible to fraud than conventional newspaper examinations.

3) Velocity: Funds can be transferred a lot more promptly than typical paper checks, removing hold-up times for deposits to remove.

4) Cost-effective: E-checks generally set you back a lot less than various other types of electronic remittance, such as credit scores memory card transactions.

Disadvantages of Making use of E-Check Means

While there are actually a lot of benefits to using e-check means, there are also some prospective downsides:

1) Restricted acceptance: Not all business accept e-checks as a kind of remittance.

2) Postponed processing: E-checks may take a lot longer to process than other types of digital remittance, such as credit rating card deals.

3) Increased threat of errors: Suggestionsing the wrong financial information could possibly lead in neglected transactions or incorrect funds moves.

4) No defense versus unauthorized transactions: Unlike credit report memory cards, e-checks do not give security versus unwarranted purchases or deceptive task.

Final thought

E-check indicates give a convenient and secure procedure for transferring funds online coming from one bank profile to another. While there are actually some drawbacks associated with this payment strategy, the benefits over-shadow the risks for numerous people and services. Through understanding Check it Out of e-check means and how they work, you can create informed decisions about whether it is the best repayment technique for your requirements.